You’ll almost certainly have seen multiple headlines about another Bank of England (BoE) base rate rise. Indeed, there have been 14 consecutive rises to the base rate since December 2021 to its current level of 5.25% as of 12 September 2023.

Although sometimes slow to filter through, banks and building societies have been increasing savings rates on their accounts. So, if you’d failed to notice the headlines, you may have seen the amount of interest on your savings start to increase.

Moneyfacts reveals that the best rates offered on different savings accounts as of 12 September 2023 are:

- 6.2% for a one-year fixed-rate bond

- 5.81% for a two-year fixed-rate Cash ISA

- 5.2% for an easy access savings account.

Even though rates on various savings accounts have started to climb, it may be wise to think twice before you hold more of your wealth as cash. Continue reading to discover three reasons why.

1. Inflation could erode the purchasing power of your cash savings

One fundamental issue with holding too much of your wealth in cash is that, over time, its purchasing power could be eroded due to inflation.

The Office for National Statistics reports that UK inflation for the year to August 2023 was 6.8%. Even though inflation is dropping from its high of 11.1% in October 2022, this is still higher than 5.2% – the best rate offered by an easy access savings account as of 12 September 2023.

This means that, over time, your cash savings would lose real-terms value since the price of goods and services tends to rise faster than the rate at which you gain interest on your cash.

The Bank of England (BoE) inflation calculator highlights how your savings’ purchasing power is eroded in real terms over time. Indeed, £10,000 worth of goods and services in 2010 would cost you £14,638.80 today.

Furthermore, the following table demonstrates how various levels of inflation could affect the real-terms value of your cash based on £10,000 in a savings account with an interest rate of 3%.

Source: Standard Life

As shown, when inflation is high, it may only take a few years before the real-term value of your savings drops considerably.

While cash savings may help you reach your short- and medium-term goals, it may be prudent to avoid holding significant sums of cash for extended periods.

2. Investments typically outperform cash savings in the long term

Even though we always recommend holding some of your wealth as cash in an emergency fund, holding more than you need is generally unwise. So, if you have excess cash savings and wish to grow your wealth and outpace inflation, it may be worth investing your cash instead.

IG reveals that the FTSE 100 stock market index offered total annualised returns of 7.48% between 1984 and 2022. This is higher than both the inflation rate of 6.8%, as of August 2023, and the best rate offered by an easy access savings account, as noted above.

As such, your wealth could outpace inflation and generate higher potential returns if you decide to invest it rather than hold it as cash.

Even if inflation was higher than this total annualised return, as it was when it reached 11.1% in October 2022, there’s a chance that this would still be higher than the rates offered by easy access savings accounts.

Of course, it’s important to note that investing carries risk, and the value of your investments could fall as well as rise. This is why it’s essential to invest with a long-term view.

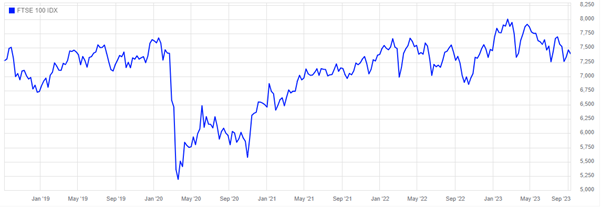

The chart below shows the five-year performance of the FTSE 100 stock market index.

Source: London Stock Exchange

As you can see, the index dropped significantly from 7,675 on 16 January 2020 to 5,191 by 19 March 2020 due to the Covid-19 pandemic. If you sold your investments here to minimise losses, you would likely have missed the subsequent recovery to 8,004 by 16 February 2023 – well above its pre-pandemic levels.

3. If you hold a sizeable sum of cash, some of it may be at risk

While it may be prudent to hold some of your wealth as cash for an emergency fund, or to meet your short- and medium-term goals, holding too much could mean your cash savings are at risk.

This is because the Financial Services Compensation Scheme (FSCS) has an upper limit on how much money it will compensate you if your bank fails. Indeed, the FSCS only protects individuals for up to £85,000 worth of losses for each financial institution.

This means that, if you have more cash savings than this upper limit in a single account and your bank or building society collapses for some reason, you could lose everything above the £85,000 threshold.

Get in touch

If you’d like to understand how much cash you should hold or discuss the long-term eroding effects of inflation on your wealth, please get in touch.

Call 01992 500261 or fill in our online contact form to organise a meeting, and we’ll be in touch.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production