It’s likely that you have a number of financial goals, ranging from saving up for your next holiday to building up a fund for retirement.

Saving and investing can help you reach your goals faster, but how do you work out what you might have in the future?

While it’s often tricky to predict how your wealth will grow, a simple formula could help you estimate how long it will take your savings to double based on the average rate of return: the “rule of 72”.

This formula gives you a ballpark figure of how long it will take your wealth to double in value, which can help you work out when you’ll have enough money to reach your financial goals. So, how exactly does the rule of 72 work? Continue reading to find out.

The “rule of 72” is a formula that helps you figure out how long it would take to double your wealth

Simply put, the “rule of 72” is a method for determining how quickly your savings or investments could double in value, based on the predicted rate of return.

This takes shape as a formula, which is:

- The number of years = 72÷ the rate of interest or return

For instance, if you held your money in a fixed-rate savings account that offered a guaranteed 3% return each year, it would take 24 years for your savings to double. This is because 72 ÷ 3% is 24 years.

Of course, this is only an estimation, though it can be a handy way to predict how your wealth will grow in the future.

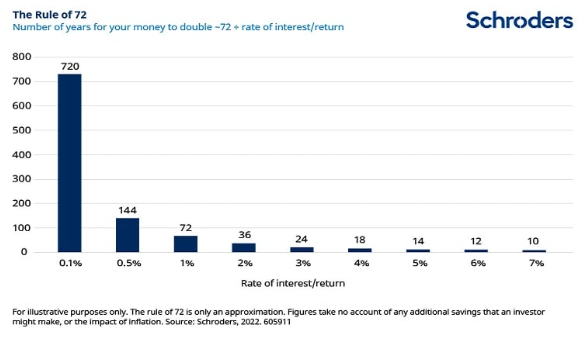

Source: Schroders

The above chart shows how long it would take you to double your money based on differing rates of return. As you can see, the higher the estimated rate of return, the less time it would take you to double your money.

For example, if you received a return of 5% a year, you could expect your wealth to double in value in 14 years.

It’s important to remember that this is only an estimate, and it’s rare for investment returns to be guaranteed. Investopedia reports that the formula is most accurate for interest rates and returns that fall between 6% and 10%.

Still, it shows that being too cautious with your money and investments could stop you from reaching your long-term financial goals. That’s because it might simply take too long for your wealth to increase in value by as much as you need it to.

Investing can typically help you reach your long-term financial goals faster

When you’re planning your future and have some long-term goals in mind, the returns you realise on your wealth can often help you establish whether you’ll have enough to achieve them.

If you’re too cautious when it comes to saving and investing, your progress towards these goals could be too slow.

For instance, if you invested all your pension savings in a low-risk portfolio with 3% returns, the rule of 72 dictates that it would take 24 years to double your money.

If you need your pension fund to double in value to achieve your desired level of comfort in retirement, you may not have that sort of time if you’re already in your 50s or 60s.

Conversely, imagine you instead invested your pension savings in a portfolio that generated returns of 5% rather than 3%. As you read above, your savings would double in 14 years.

Data from BlackRock shows that European shares returned an average of 5.5% annually between 2014 and 2023. US shares returned an average of 12.6% a year during this same period.

Meanwhile, cash returned an average of 0.8% over this period.

As you can see, investing can offer you the potential for higher returns. Thanks to the rule of 72, this means you could potentially double your money quicker and reach your long-term financial goals faster.

Remember that the value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Get in touch

We can help you build a strong portfolio of investments so you can work towards your long-term financial goals.

To find out more, please call 01992 500261 or fill in our online contact form to arrange a meeting, and we’ll be in touch.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

Production

Production