We’ve certainly had a year of turbulence: three prime ministers, four chancellors, multiple Budgets and U-turns, a war in Ukraine, rampant inflation, energy and cost of living crises and a controversial football World Cup in November. Just turning on the news nowadays is an act of bravery.

With so much negative news around, it’s reasonable for you to feel unsettled. You will have seen the value of investments go down, but with a diversified portfolio, it won’t have gone down as much as the media has suggested and, in many cases, you will also have seen values go back up again.

If you are retired on a comfortable income, you may be more worried about your family than yourselves.

Investment markets don’t like uncertainty

We know that investment markets don’t like uncertainty either; there’s no real evidence that they prefer one political party over another, but they do like an amount of predictability.

Investment markets are essentially a visible expression of the emotional sentiments of many people making financial decisions based on what they see and hear around them. That sentiment can change quickly for the better, not just for the worse.

With this in mind, small changes unrelated to finance can lift everyone’s mood. Things like declining inflation, interest rate increases slowing, and supply chain improvements will all have a huge effect on investment sentiment. These things will happen; we just do not know when.

2022 also brought the second bear market in three years, which is defined a market decline of more than 20%. While not as sharp as the 2020 event, we saw a protracted decline of 25% that played out over 10 months from January to October.

While we are still in negative territory, with a few concerns unanswered, we remain confident that capital markets will, over time, reward those who invest and stay invested.

This year has been a very rare period for investment assets with almost nowhere to hide. It is only the fifth year in the past 100 years in which equities and bonds have fallen at the same time. The bond market, which is typically low risk, was down 24% at one point this year but has shown signs of stabilising more recently.

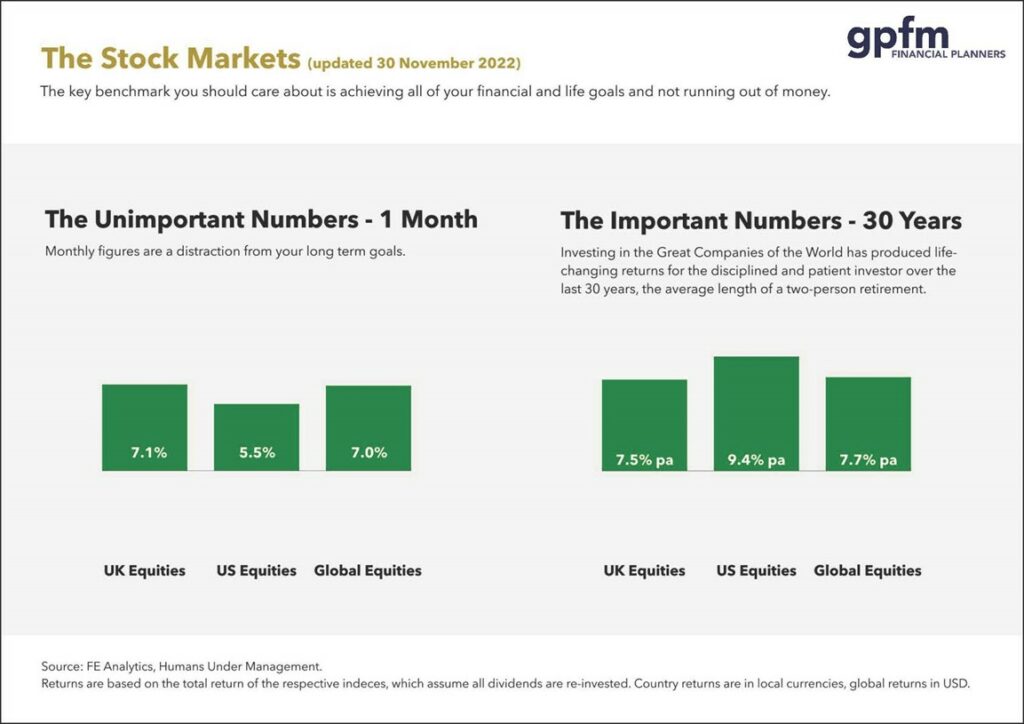

Equities have also shown the green shoots of recovery in the past month, but as always, we urge you to look at the long term and, as much as possible, ignore the short-term volatility and news. Portfolios typically deliver over the long term and tend to meet your objectives.

3 important lessons from 2022 that we are taking into the new year

The current thing comes and goes

The entire globe being obsessed with one idea is not a new occurrence, but modern technology means that it’s no longer a phenomenon reserved for world wars and World Cups.

Chosen by those who control the media narrative, we cycle through one fashionable outrage after another, few of which are likely to matter much in five years.

The nature of the connected world we live in means that most people are almost powerless to resist getting caught up in the idea of the day. However, we’ve learned that making long-term investment decisions based on short-term concerns is not a recipe for success.

The lesson? The year 2023 will bring its own events that will dictate our lives and financial market sentiment for a few months. We recommend you prepare yourself to see these for what they are: a distraction.

Things work, until they don’t

Similarly to the “current thing”, there is almost always an investment idea that is in vogue. For the last few years, this has been the concept of digital money – things such as cryptocurrency, decentralised finance, and non-fungible tokens (NFTs).

Starting as a small scene within the technology community, it quickly became a mainstream phenomenon as it rode one wave after another.

Over the last few years, a guise of regulation and a flood of venture capital money entered the space. The fear of missing out resulted in many regular investors joining the fray, further inflating the perceived value of this new asset class.

While all new ideas deserve our consideration, they must clear a very high bar before it deserves a sizeable allocation of your hard-earned money. That time has not yet come, and with the enormous failures of governance and fraud seen in this space over the last few months, we feel safe putting this idea to bed.

In contrast, the things that have always worked continue to march along, making those with patience and discipline slowly wealthy. If something sounds too good to be true or stirs up the hope of quick riches, it may be best to steer clear.

Live like a local, not a tourist

A trip to a favourite travel destination is often planned very carefully. A significant factor for most visitors is the seasonal weather patterns that can ruin a holiday.

Understandably, tourists avoid problematic periods when possible. In contrast, locals understand that the seasons change and know how to stick it out.

Similarly, smart investors understand that even diversified portfolios experience temporary declines and volatility as they are tossed around by the waves of human sentiment. As we head into 2023, on the back of what looks to be the first calendar year of negative returns since 2018, we encourage you to maintain the mindset of a local.

Be aware that the financial seasons change, and rather than giving up on the destination, come prepared with an umbrella.

Thank you

All of us here at GPFM wish you a safe and happy holiday and hope that the coming weeks will allow you to do things that bring you joy with the people you love. Thank you for the opportunity to work with you and your family and as always, we are available to you if there’s any need.

As always, if you ever need to speak to us for any reason, please don’t hesitate to get in touch. Please call 01992 500261 or fill in our online contact form to organise a meeting and we’ll be in touch.

Production

Production