The government have announced that the normal minimum pension age is increasing from 55 to 57 in April 2028. This means that you’ll need to be 57 before you can start drawing your defined contribution (DC) pension.

Initially, this may seem like a negative thing – after all, you’ll need to work for longer before you can officially put your feet up and relax. Despite this, there are some factors that mean the pension age increase could actually be a good thing for your long-term financial prospects.

So, from more pension contributions during “peak earnings”, to more time for your investments to grow, read on to find out why the pension age increase could actually be good news for your savings.

The normal minimum pension age is rising to 57 in April 2028 in a move to increase labour market participation

As of April 2023, the age at which you can first access your DC pension is 55, although this is increasing to 57 in April 2028. This means that the changes will affect all workers currently aged 50 and under.

The “normal minimum pension age” (NMPA) was initially introduced in 2006 at age 50, then rose to 55 in 2010. Then, following a consultation on the “Freedom and Choice in Pensions” in 2014, it was announced that the NMPA would rise to 57 in 2028 to coincide with the State Pension Age increase to 67.

The government say that the move could benefit the economy through increased labour market participation, while also ensuring that pension savings will provide retirees with a sustainable income for later life.

It’s useful to note that there are some scenarios where you may still be able to draw your pension from age 55. For example, if you’re already in a scheme with an unqualified right to take your pension from 55, you’ll still be able to do so. Though, if you joined a new scheme after 11 February 2021, you likely won’t be able to access your pension benefits until you reach 57.

It’s also worth remembering that if you transfer from an existing pension scheme to a new one, you could lose the right to access your pension benefits before age 57.

At first glance, this change may seem negative – after all, you’ll need to wait longer until you can retire and access your pension savings. Though, it may not be as bad as it seems, so continue reading to find out how the NMPA increase could actually be a good thing for your retirement savings.

Why the pension age increase could actually be a good thing for your wealth

Firstly, and perhaps unsurprisingly, the additional two years of saving means your total pension pot will likely be larger by the time you eventually reach NMPA.

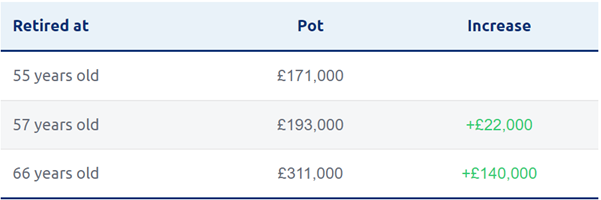

For instance, Standard Life reports that someone on a £25,000 salary that pays the standard auto-enrolment contributions – 3% from the employee, 5% from the employer – from the age of 22 would have a total retirement fund of £171,000 by age 55.

Meanwhile, if the same person retired two years later, they would have a total pot of £193,000 by the time they reached age 57. As you can see, just two more years of working would boost your pension pot by £22,000 in the above example.

Similarly, if you continued working until age 66, your pension pot would grow substantially to £311,000, as shown by the table from Standard Life below:

Better yet, you’ll likely be earning more towards the end of your career than you did in your early years. This means this extra two years of working could have a really positive impact on your pension pot, as you’ll likely be making percentage contributions based on “peak earnings” at this point.

Similarly, since you’ll need to wait an additional two years before you can retire, there’s a chance your investments could grow in value over this time frame. This could leave you with a significantly larger pension pot when you eventually do retire.

Also, as life expectancies rise, you will likely need more money saved to support your lifestyle during retirement. For example, the Office for National Statistics reports that baby boys born in 2020 in the UK can expect to live to age 87.3, while baby girls are expected to live until an average age of 90.2.

If you’re working for an extra two years, your pension pot will need to support you for two fewer years during retirement. This could be the difference between not having enough money saved and having adequate funding to support yourself during retirement and live the lifestyle you’ve always dreamed of.

So, while the NMPA rise may initially seem like a downside, it may actually be a good thing for your long-term financial situation.

Get in touch

Before the pension age increases, it may be wise to review your savings goals with a financial planner to see how the changes affect you.

Please call 01992 500261 or fill in our online contact form to arrange a meeting to find out how we can help you.

Please note

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

Production

Production